By Anthony Uwadiegwu

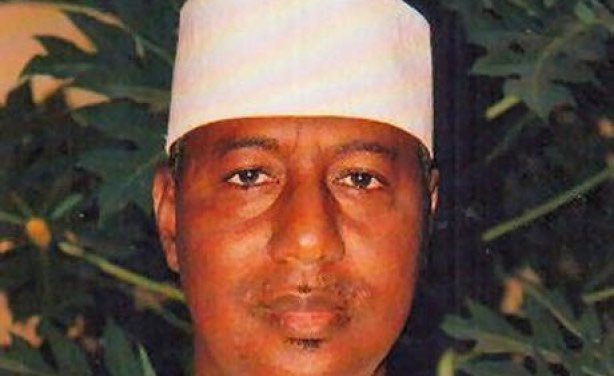

CALABAR (CONVERSEER) – In this interview with Anthony Uwadiegwu, Cross River State Commissioner for Finance, Dr Mike Odere, speaks on his transition from the private sector to public service, the state’s economic direction under the leadership of Governor Bassey Otu, and ongoing reforms aimed at boosting growth, investment, and transparency.

Excerpts:

Q: You came into government from the private sector. What were the major challenges of navigating the transition?

A: For many of us coming from the private sector, the first challenge is adapting to systemic issues in government. In the private sector, efficiency and profitability drive processes, so bureaucracy is shortened through automation and accountability. But in the public sector, the bureaucracy is rigid and procedures are longer.

What helped me integrate smoothly was relationship management and learning how to build consensus rather than imposing change. You must show people the benefits of reform rather than the costs, and that way, it becomes easier to adapt and align processes positively.

Q: Two years into this administration, how has the state fared economically?

A: Development is both about perception and reality. Public perception, investor confidence, and multilateral agency assessments matter. When we came in, we reassessed our finances and focused on cleaning up grey areas that created scepticism.

Today, about 60 per cent of government processes in key ministries are automated. We are expanding infrastructure, creating visibility, and restoring trust. For instance, new hotels and investments are springing up in Ogoja, while Obudu Ranch Resort is undergoing rehabilitation to regain its place as a major tourist destination. These developments reflect growing investor confidence.

Q: This administration is pursuing ambitious projects such as the Bakassi Deep Seaport and the Cargo Airport. How are you balancing capital projects with limited resources?

A: It is a delicate balancing act. Debt servicing and infrastructure obligations are heavy, but Governor Otu has been deliberate in maintaining transparency and trust. We started with low-hanging projects, fixing roads, improving street lighting, and enhancing security communication, because if people feel safe and see progress, investors will come.

We also engaged international rating agencies. Recently, FISH, an independent body, assessed our processes and gave us a stable rating. Beyond that, we are driving value addition in agriculture. We have introduced soil mapping, a cassava framework, and launched a Special Agro-Processing Zone. This means that in the coming years, we will have factories processing cassava, rice, cocoa, yams, plantains, and bananas, turning raw produce into finished goods. That will create jobs, improve revenue, and attract further investment.

Q: Trust seems central to your investment drive. How are you rebuilding it?

A: When we came in, there was virtually no record of Foreign Direct Investment. Many investors had left, citing loss of trust. We had to reverse that by engaging communities and ensuring inclusive participation.

For example, if we site a cassava factory in a village, we involve local farmers, allow them to keep their land, provide inputs, and guarantee off-take of their produce. This shared ownership ensures the community protects the facility. That is the kind of model that reassures investors.

Our bigger projects, like the Bakassi Deep Seaport, are bold and transformational. Critics once called them too ambitious, but the reality is that such infrastructure will not only serve Cross River, but also Nigeria, West and Central Africa. All we need to show investors is that our government is responsible and transparent enough to sustain the project.

Q: What is the tax regime like in the state?

A: We have automated our tax processes to eliminate leakages. Payment and clearance are now more transparent, and people can see the dividends of their taxes in improved infrastructure, safer communities, and better markets.

The Internal Revenue Service, under its current leadership, has streamlined tax administration, improved IGR, and ensured fairness. Automation has also cut out racketeering and made it easier for taxpayers to trust the system. Ultimately, taxation works best where there is trust, and that is what we are building.

Q: How has the state budget performed so far?

A: Last year, our first full year in office, we achieved about 80 per cent budget performance. Recurrent expenditure naturally recorded full implementation, while capital expenditure was lower due to the transition phase.

However, we made bold commitments, such as the outright purchase of two aircraft, not a wet lease, which reflects the seriousness of our administration in building assets. Overall, I would say Cross River is doing well in terms of development indices, with real growth and tangible progress on multiple fronts.